I’ve been working in real estate since 1979, so I’ve seen a lot.

My feeling is that we are in a housing crisis because we aren’t approving enough housing. Construction is not the issue – Canadian builders are amongst the most skilled in the world.

Getting a new home project approved takes several years and can cost hundreds of thousands of dollars. That’s where the bottleneck is.

So, I am thrilled to have played a role in shaping the vision for the development of a new home community that’s the most innovative I have ever seen in Ontario. It offers an unmatched opportunity, with detached homes starting from $399K.

Imagine a 100+ acre site with only natural gas and electricity services available. Normally, such a site would have to wait years for municipal water and sewer infrastructure to become available – a costly, time-consuming and complex process.

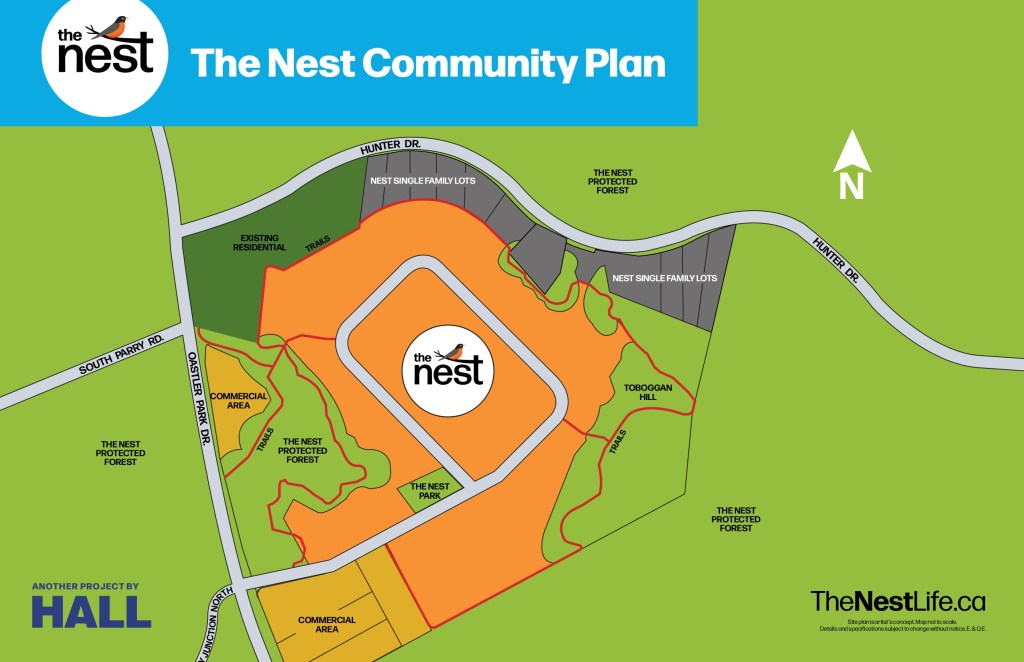

Enter The Nest, a revolutionary new home community in Seguin Township, beside Parry Sound, envisioned by Hall Development Group, an arm of Hall Construction. This company is using its expertise in land servicing and earthworks to create private water and sewer infrastructure. Private individual septic systems and wells shared by up to five homes are the reasons this new home community was able to be conceived and launched in record time and at prices never before seen.

It took conviction and past experience to believe in the viability of the vision and then work with the Hall team to execute it. The Nest offers a bold new model for how housing in Ontario can be built and approved.

Also unique are the condo tenure with homeowner land ownership and the siting of the homes in clusters of five homes set into the natural landscaping to minimize disruption, as opposed to overwhelming the environment with rigid subdivision design. Even the architecture of these right-sized homes is refreshing.

Kudos to Seguin Township for embracing Hall’s vision and for helping to make it happen – it’s encouraging to see such bold and progressive leadership.

Visit TheNestLife.ca to learn more. I’d love to hear what you think.